What Is the Crypto Fear and Greed Index?

The Crypto Fear and Greed Index is created to measure the greed and fear level of investors in the market. In this article, let’s find out more detail about it and the reasons why many traders prefer to use this index to help them find the right time to enter and exit the market.

Understanding the Crypto Fear and Greed Indicator

Have you ever considered the possibility that, despite making a sound investment plan, it might still be destroyed in a matter of seconds by a market participant's panic or greed? The "Fear of Missing Out" (FOMO), for instance, as public and private organizations and corporations devote their attention to Bitcoin, is one stimulus that can cause these market attitudes. Due to their fear that the price would increase above its current level as a result of this, the majority of investors may flood the market with purchase orders, ultimately pushing the price up. When a group of investors start to panic and sell their assets alongside the bad news that emerged during the price decrease, the worry of becoming stuck at such a high price also creates a change in investors' emotions.

How can investor sentiment be measured when it directly influences an asset's price behavior?

Investors worry about keeping assets when there is a crisis that results in selling pressure on the markets, similar to the stock market. At that point, analysts choose an index to examine to gauge the level of investor fright on the US stock market.

What we covered above is the Volatility Index, sometimes known as the VIX Index. It leverages the derivatives market's trade volume to construct an index. The VIX will fluctuate in accordance with market sentiment and high net worth and institutional investors' investment plans.

The Crypto Fear and Greed Indicator is a comparable index that may be used to assess investor attitudes in the cryptocurrency market.

How to Use the Crypto Fear and Greed Index?

Source: Cointelegraph

The bitcoin market may occasionally be unpredictable, as you probably already know. Investors' emotional reactions to the market have contributed to some of this. People may get avaricious and experience FOMO (Fear Of Missing Out) when the market is rising. They could also feel fear and sell their coins when the market is plummeting.

Many traders use the index as a market indicator, a tool that supplies them with market data so they may trade more wisely. By examining the emotions and broader moods impacting the market, many traders have outperformed it.

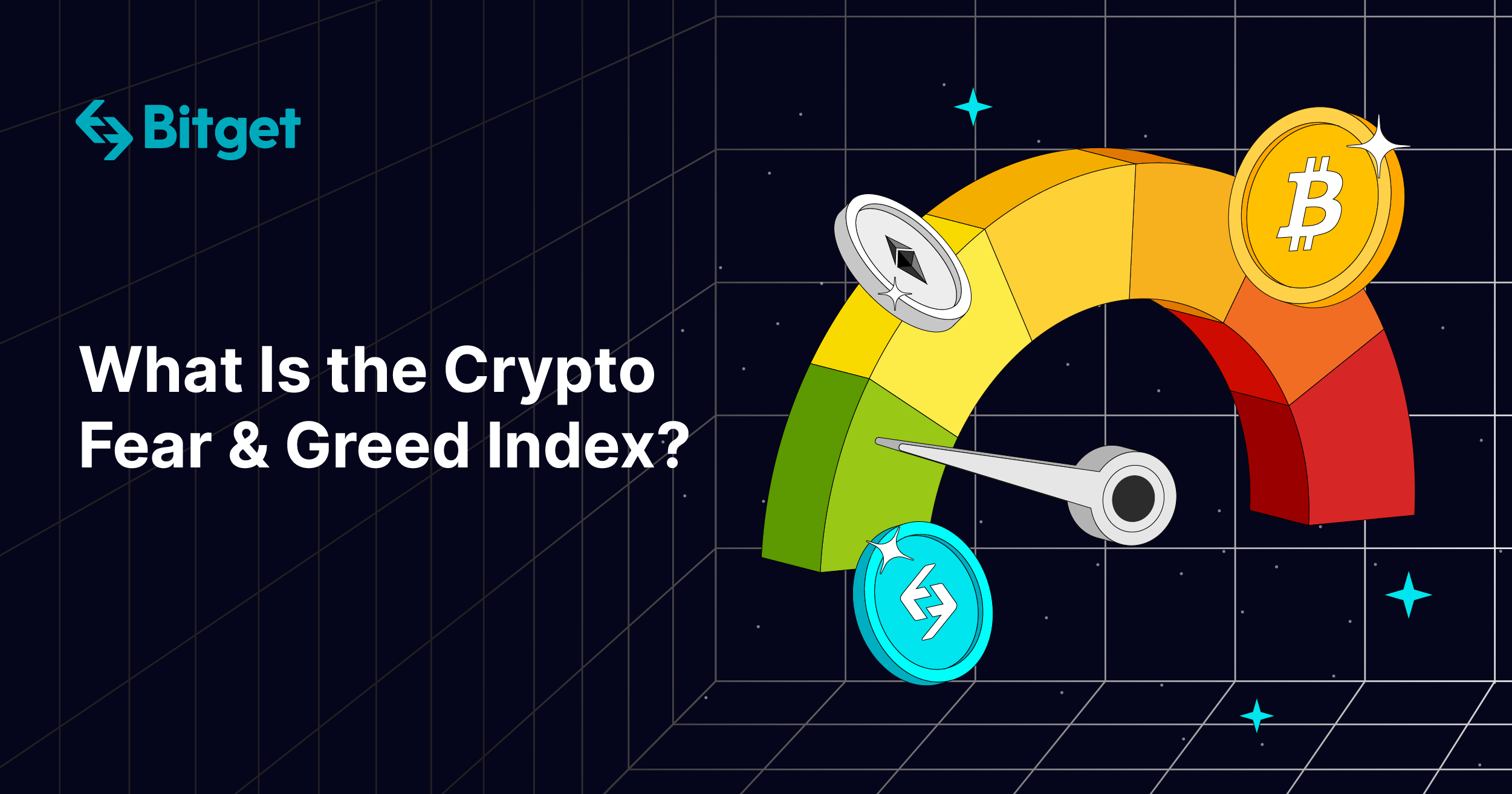

Scaling from 0 to 100, 0 represents severe fear, and 100 represents extreme greed. The index's creators suggest utilizing it to facilitate trade in the following ways:

1. Because investors are too anxious, intense anxiety may present a purchasing opportunity.

2. Extreme greed may indicate that investors are acting unreasonably greedy and that a market correction is overdue.

How is the Crypto Fear and Greed Index Calculated?

The Alternative uses a variety of data sources to compute the index, including volatility, market momentum/volume, social media, dominance, and trends. Additionally, although the signals are focused on bitcoin, other significant cryptocurrencies may soon be included in the index.

The five important indicators are examined in further detail below:

1. Volatility - A surge in volatility is taken as an indication that the market is scared.

2. Market momentum/volume - The current volume is contrasted with the market momentum. When buying volumes exceed longer-term momentum, it indicates that the market is becoming overly greedy.

3. Social media - An extremely high engagement rate is used to spot greedy market behavior using a Twitter sentiment analysis tool.

4. Dominance - A rise in bitcoin dominance is perceived as a symptom of a nervous market migrating to a safer asset, whilst a decline in bitcoin dominance is seen as a sign of a greedy market moving to more speculative altcoins.

5. Trends - Information from Google Trends is utilized to determine the volume of internet users looking for information on bitcoin. A rise in certain search phrases, such as " bitcoin price manipulation," is regarded as a worrying sign, but "bitcoin price forecast" would be more bullish.

What the Crypto Fear and Greed Index Doesn’t Do?

The Fear and Greed Index is informative, but it doesn't provide information to investors about when to buy or sell, and it doesn't purport to make any accurate forecasts about the future. Therefore, prices may increase further and remain there even if the market is experiencing tremendous greed. In a similar vein, prices could drop much more and stay low for an unforeseen amount of time if the market is experiencing significant panic.

Overall, while choosing when to buy cryptocurrency, investors should take into account several fundamental analysis (F/A) measures in addition to the Crypto Fear and Greed Index. Some long-term investors have historically preferred to dollar cost average (DCA), buying equal or almost equal amounts of cryptocurrency at regular intervals over lengthy periods, regardless of whether the market is afraid or greedy.

The Fear and Greed Index is also useful for swing and day traders, but it should only be used in conjunction with several other technical analysis (T/A) tools and metrics. For instance, a day trader may find it more advantageous to take tiny short positions when the market is afraid and daily falls are frequent, whereas they may find it more advantageous to take large long positions when the market is greedy. Investing in cryptocurrencies is risky no matter the strategy, and traders and investors alike should always be ready to lose their entire investment.

Related articles:

A Guide to Cryptocurrency Fundamental Analysis

Trading 101: Technical Analysis Explained

What Is Dollar-Cost Averaging?

Is it a short-term or long-term indicator?

The historical chart demonstrates that the longer-term bull runs and the Crypto Fear and Greed Indicator do not closely connect. Instead, it reacts to recent events and brief variations in the price of cryptocurrencies. Due to these variables, traders prefer it as a short-term indicator over a long-term one. Trading enthusiasts particularly enjoy it, as one might expect.

Conclusion

For cryptocurrency traders, investors, and market watchers, the Crypto Greed and Fear Index is a great benchmark. It does, however, have some drawbacks, such as its narrow focus on Bitcoin at the expense of other crypto assets like ETH and stablecoins.

The index's tracking and data-calculating methods are also not entirely transparent, especially when it comes to its study of social media and trends. Additionally, it does not disclose the precise formulae it employs to estimate volatility, volume, and market momentum. For people attempting to use the index practically, all of this information would be very helpful. As was already noted, the index should only be one of several data points used to track the cryptocurrency market and should not be significantly depended upon to make investment or trading decisions, despite the fact that it is helpful in doing so.

Want more insights like this? Follow us and turn on the notification now:

Twitter | Telegram | LinkedIn | Facebook | Instagram

Disclaimer: This article is for educational purposes only and is not intended as investment advice. Qualified professionals should be consulted prior to making financial decisions.